Continuous Bulding on a Cathedral to Prevent Disaster

Introduction

Natural disasters represent a major threat to Cultural Heritage, especially considering that meteorological, hydrogeological and climatological events have been growing worldwide in the last decades due to the climate change phenomenon. As reported by the European Parliament, "Hurricanes, floods, earthquakes, landslides, volcanoes, wind effects, fires, environmental fatigue or similar long-term climate effects and other disasters sometimes cause irreversible damage to Cultural Heritage, or completely destroy entire areas of Cultural Heritage, both movable and immovable" (European Parliament 2007).

On one hand, Italy is a country famed for its heritage, which is one of the largest in the world (over 3400 museums; 2100 archaeological sites; 24 national parks; 23 marine areas and 50 UNESCO World Heritage cultural sites Footnote 1). On the other hand, Italy is a country particularly exposed to natural disasters (since World War II onward, 149 ascertained natural disasters have taken place and among these: 69 hydrological: floods, landslides; 42 geophysical: earthquakes, volcanic activities; 38 meteorological–climatological: storms, extreme temperatures, drought). Footnote 2 To that reference, as an example, two important disasters that affected Italian Cultural Heritage are: the 1997 earthquake that destroyed the San Francis Basilica in Assisi and the 2009 earthquake that damaged the L'Aquila Cathedral.

Therefore, it is more necessary than ever to provide risk management strategies to deal with the effects and consequences of future disasters and concerning the protection of Cultural Heritage, a relevant role could be played by insurance instruments. As is recommended at a European level "Due to a socio-economic dimension of resilience, this requires dedicated research and the development of methodologies to better evaluate the financial and humanistic consequences of disasters impacting Cultural Heritage, taking into account its intangible values. In particular, co-operation with the insurance companies across Europe has not been sufficiently developed to help support resilience through private insurance contributions" (Bonazza et al. 2018).

In this direction, the paper presents an analysis of the role of insurance in the case of Italian Cathedrals, not yet explored in literature, with the aim to contribute to the scientific debate on finding out how to protect Cultural Heritage, promoting appropriate risk management strategies that take into account its innate significance and its relevance.

To reach this goal, Sect. 2 is focused on the definition of the economic values of Cultural Heritage and the specific case of Cathedrals; Sect. 3 provides a literature review on the relationship between Cultural Heritage and natural disasters; Sect. 4 analyzes the use of insurance in the risk management of Cultural Heritage; Sect. 5 presents an empirical analysis of the diffusion of insurance policies in Italian Dioceses, based on a questionnaire to Dioceses administrators, and the results are commented concerning the efficiency in safeguarding the Cathedrals cultural assets.

Assessing a broad definition of the economic values of Cultural Heritage and the case of Cathedrals

In 1972 UNESCO defined Cultural Heritage as a combination of monuments, group of buildings and sites, that is to say, works of men, combined works of Nature and Man, and archeological sites (UNESCO 1972). In 1992, this definition was applied to identify cultural landscapes as combined works of Nature and Humankind, and therefore as a component of Cultural Heritage (UNESCO 1992). The last step can be seen when in 2003 intangible Cultural Heritage was included in the World Heritage List (UNESCO 2003).

The purpose of this continuous evolution of the Cultural Heritage concept, from tangible to intangible elements, is to give a representation of all cultural phenomena and to identify the appropriate ways to safeguard them. The acknowledgment of intangible aspects such as local traditions, practices and craftsmanship, moves in the direction of the acceptance of cultural diversity as a source of enrichment for the whole of mankind (Vecco 2010).

All the components of Cultural Heritage are denoted by the same characteristics, which allow them to be included in the World Heritage List. Throsby (2001) identifies three main connotations: cultural goods have to be related to some form of creativity, symbolic meaning and intellectual property. The correct identification of these elements and the related cultural goods are fundamental to assess the correct cultural and economic value. These two elements are strongly connected to each other, such that it is possible to affirm that a causal relationship between the two exists (Angelini and Castellani 2019). In particular, this connection starts with the evaluation of the "cultural" value in order to determine the relative "economic" value. The former is composed of different values: aesthetic value, historical value, social value, spiritual value and symbolic value (Throsby 2001).

The set of these factors allows us to identify a good as a cultural good and to assess its economic value. The latter is defined as the value that "comprises any direct use values of the cultural good or service in question, plus whatever non-market values it may give rise to" (Throsby 2003). Footnote 3 This means that in order to assess the economic value of a cultural good, it is necessary to measure "the value of the flow of services yielded by the cultural good and to estimate its value as an item of cultural capital stock" (Throsby and Zednik 2014).

Cathedrals represent one of the most important components of Cultural Heritage, because they are characterized by a great artistic, historical and religious relevance. Taking into account Throsby's classification above, they show all the values reported: aesthetic, historical, social, spiritual and symbolic. In particular, as liturgical and spiritual hearths of the Italian Dioceses, they stand out due to their religious significance and therefore they are particularly important for the community, so that it allows us to consider them as a particular case of study.

What is more, Cathedrals are important from another perspective. They are not only cultural goods, as said before, but they also contain relevant cultural goods, such as paintings and monuments. All these elements meet the need for representation and proof of Jesus's and Saints' lives, in a doctrinal vision. By admiring the architectural and artistic beauties both inside and outside, the message they communicate is a sense of holiness and solemnity. Indeed, Cathedrals are built not only to be admired from the outside but above all to embrace the community of believers (Marini 2010).

Furthermore, they perform a function of Mother Church of all the other churches that are part of the same Diocese, therefore increasing their spiritual value. They were built for all the diocesan community, guided by the Bishop who heads the Diocese and leads the Christian faith.

Cathedrals have also a social function not only for their geographic collocation (in many cases, they are in the center of the cities) but also for their essential role as meeting points for the community, as well as marks of local identity. This aspect helps to create a sentiment of social cohesion and sensitize people to their preservation and respect, as a landmark for the local community and a fulcrum for the urban system.

According to Throsby's classification, all the aspects above mentioned contribute to increasing the value of Cathedrals with respect to their "vulnerability" to natural disasters. As in Maio et al. (2018), vulnerability can be defined as an intrinsic predisposition of an element to suffer damage from an event of a given intensity. In addition to the vulnerability feature, there are three other aspects that are closely related and that should be considered: the physical and environmental aspects, social aspect and economic aspect. The first is related to the natural exposure of a specific territory, the second to the capacity of a community to cope with these extreme situations and to find an incisive contrast strategy, while the third concerns the potential economic losses deriving from a disaster (De Masi and Porrini 2018).

But, in the case of Cathedrals, the connection with cultural values leads us to take into account not only the three aspects indicated above but also the one linked to the specific religious element here considered. In this case, as far as Cathedrals are concerned, the focus has to be on the preeminent religious and spiritual aspects they have.

Differently from private buildings, the exposure of Cathedrals to natural disasters includes specific evaluations linked to their nature. Because of their intrinsic values, Cathedrals need to be preserved in a special way. They represent a manifestation of past human activities and help people to better understand their history and culture.

"Humankind needs tangible evidence of the past as reminders. Heritage sites present people with certainties, familiar surroundings which provide assurances and reassurances" (Spennemann 1999). With respect to Cathedrals, they are part of our history and culture: having inherited this heritage from the past, it is absolutely important to safeguard it for future generations.

All the considerations above play an important role in the evaluation of the relevance Cathedrals have in our society. And, as said before, this represents a starting point to finding out the best practice to follow in order to protect this heritage. Concerning the examined case, safeguarding Cathedrals means not only enhancing the historical monument but also all the intangible elements that are intrinsic to this type of cultural asset.

Cultural Heritage and natural disasters in literature

The relationship between Cultural Heritage and natural disasters represents an important topic in literature, both from an institutional and a scientific point of view.

Starting from the former, the European Commission, in 2018, published a study (Bonazza et al. 2018) that presents a comprehensive overview of the existing knowledge on safeguarding Cultural Heritage from the effects of natural disasters. In particular, they fix three specific study objectives (Providing an overview, Mapping the existing strategies, Putting forward recommendations) with the aim of supporting the implementation of the four Sendai Framework Action Plan Priorities: Understanding disaster risk, Strengthening disaster risk governance to manage disaster risk, Investing in disaster risk reduction for protecting Cultural Heritage assets and Enhancing disaster preparedness for effective response and to "Build Back Better" in recovery, rehabilitation and reconstruction.

Looking at the scientific literature, many scholars have analyzed Cultural Heritage and natural disasters with different approaches, according to the several perspectives from which this subject takes relevance.

One of the most relevant aspects that should be considered is the one of the importance covered by heritage preservation. As stated in the previous section, we have inherited Cultural Heritage from the past and we have to safeguard it for future generations. According to this line of thought, Spennemann and Graham (2007) underline the centrality of the Cultural Heritage to the emotional wellbeing of an affected community in the disaster-recovery phase, identifying its protection and safeguard as a fundamental strategy to adopt.

Moving to this direction, in their book, Stapp and Longenecker (2009) describe a risk management approach that can help to identify those actions to avoid archaeological disasters. Trying to reach a similar goal, Taboroff (2000) identifies nine principles for heritage risk management, mainly based on planning, mapping, documentation and preparedness requirements, with associated priority actions, in order to increase effective risk management of cultural assets. In this sense, an interesting focus is provided by the Climate Change issue. Adaptation policies are becoming more and more important nowadays, also finding applications in Cultural Heritage preservation (Sesana et al. 2018). Although limited research has been done, the capacity to cope with this phenomenon is fundamental together with the identification of adequate adaptation strategies in the preservation and management of cultural assets. Due to the high exposure to climate-related events, it is necessary to define guidelines and recommendations to implement these kinds of measures to obtain not only Cultural Heritage protection but also enhance the preparedness of landscape for natural disasters (Dastgerdi et al. 2019).

Management plans can be also well adopted in urban scenarios. As a matter of fact, Daungthima and Hokao (2013) focus on urban flood disasters, funding interesting theoretical and management implications for urban planners and architects to mitigate the impact of those events on Cultural Heritage.

In this strand, the role of insurance as a protection tool emerges in Vecco and Imperiale (2017). In analyzing the dichotomy of values, both cultural and economic, of cultural assets, they underline that insurance is an instrument that has to be used to safeguard Cultural Heritage from disasters and not to commodify cultural goods.

Many papers present an in-depth study of some specific natural disasters that hit Cultural Heritage. A clear example of this strand is represented by Sugio (2015). In his work, he analyzes the damage that occurred from the East Japan Great Earthquake and other disasters on Cultural Heritage, taking into account remedial measures and the need for sustainable protection and management.

Another important threat is represented by bushfires. In particular, by assuming that during and after a bushfire event Cultural Heritage is at its most vulnerable, Laidlaw et al. (2008) make an interesting study about the Australian Bush Fire Management Plans and its suitability.

In examining all the different perspectives from which this problem can be faced, an increasing interest in the topic emerges together with the need to adopt an interdisciplinary approach in assessing Cultural Heritage and resources (Fatorić and Seekamp 2017).

Using insurance in the risk management of Cultural Heritage

According to Abraham (1995), insurance plays three economic roles. The first is risk transfer: risk is transferred from a risk-averse individual to the risk-neutral insurer. The second is risk pooling: by insuring numerous policyholders, the individual's insured "uncertainty" is converted by the insurer's "certainty" that such a risk will occur into the premiums paid by the customers. The third is risk allocation: the premium paid by each insured party should reflect its own level of risk.

Given the three economic functions just mentioned, it seems clear that insurance contracts enhance social welfare while at the same time inducing the holders to take preventive action, encouraging the risk-averse insured party to make investments, because the pricing of risks generates a clear economic benefit from precautionary spending. Consequently, risk transfer, risk pooling and precautionary risk mitigation constitute the optimal portfolio of economic risk management.

Looking at Cathedrals and given the cultural and economic value above defined, this is a case where it is expensive to repair after damage has occurred, and no matter how well we carry out the restoration work, the loss of historical fabric could be irreversible. "Thus, the preservation of Cultural Heritage assets must guarantee not only their capacity of lasting over time against natural decay without losing their authenticity and usability but also their capacity to withstand natural hazards and extreme events with limited and expected structural performance" (Maio et al. 2018, p. 242).

In this specific case, the role of insurance emerges as a particularly suitable tool both from an ex-ante and an ex-post point of view. The former, because it allows us to make an in-depth analysis about vulnerability aspects and the exposure to disaster risks of these important cultural goods, necessary for the calculation of the premium; the latter because it allows them to benefit from coverage for the damages and the consequent reconstruction (De Masi and Porrini 2019).

Insurance, in fact, is an effective complementary countermeasure for unexpected losses brought about by natural hazards (Gizzi et al. 2016). It can aid in well understanding all the risks connected to extreme events and in decreasing the relative immediate long-term financial losses (Kunreuther 2015).

Looking at the ex-post point of view, the insurance cover is a fallback position, which provides compensation in the event of damage in order to finance in whole or in part repair or reinstatement. In this role, generally, insurance could be considered an alternative or a complement to Government interventions which, after an event, finance the costs to restore the previous status. Therefore, insurance can substitute or support Government intervention (Coviello 2013) and an effective multi-sectoral partnership may be implemented, for example helping the insured with tax incentives for the payment of premiums and prevention activities, to manage disaster risks and minimize economic losses.

However, to evaluate the role of insurance as a risk management tool it has to be taken into account that the insurance market is not a perfect market in which risk-based insurance products always send the correct signals to the market regarding the actual economic cost of managing risks. In reality, insurance markets are rather imperfect, in particular for the presence of information asymmetry that gives rise to adverse selection, moral hazard and charity hazard (Porrini and Schwarze 2014). These three factors lead to an increase in insurance premiums amounts which then cause a situation of low spread with a small percentage of insureds.

More specifically, due to asymmetric information, insurance companies face the difficulty of collecting information regarding the level of risk. The latter aspect leads to the phenomena of adverse selection, moral hazard and charity hazard.

Adverse selection arises if an insured party knows better than the insurer that it is likely to suffer a loss. In this case, an insurer cannot respond to a known level of risk by charging the correct premium, but can only calculate the premium on the base of the average level of risk. Insured parties characterized by low levels of risk are not willing to insure themselves at a premium based on the average risk, while high risk insureds are unwilling to reveal their character to the insurer. Adverse selection means that in the market, mainly high risk individuals purchase the policies, the refunds become more than expected and finally, the potential for a hidden high risk may disrupt the market itself.

Moral hazard occurs when the knowledge that damage will be compensated reduces the incentive for an insured party to prevent the loss. Moreover, third-party payment after losses reduces the out-of-pocket cost to the policyholder and leads to overspending (moral hazard ex-post).

Charity hazard expresses the "individuals' tendency not to insure or take any other mitigation measures because of the reliance on expected financial assistance from federal relief programs or donations by other individuals" (Raschky and Weck-Hannemann 2007). The effect on the market efficiency is the reduced incentive to purchase insurance against disaster damage in anticipation of governmental and/or private assistance.

In Table 1, we summarize these three situations of asymmetric information in the market, as factors that influence the efficiency of an insurance system.

For what concerns the Italian insurance market for natural disaster insurance, the presence of asymmetric information problems has been empirically tested (Porrini 2015). In reality, the Italian insurance market shows a very low penetration of natural disaster coverage and only 2.5% of private houses are insured according to ANIA (2018).

Considering Table 1, the research question that will be addressed in the following parts of the article is mainly based on the way Italian Dioceses cope with these situations of asymmetric information.

In this direction in the following section, the Italian Cathedrals' case is analyzed, with data collected from a survey to test the diffusion of insurance policies covering natural disaster consequences and verify how this kind of insurance system performs in terms of market efficiency.

A survey investigating the use of the insurance instrument by Italian Cathedrals

In this section, the results of a survey regarding the insurance choice of Italian Cathedrals will be presented and analyzed. Referring to what has been affirmed in the previous sections, the purpose is to evaluate whether this choice takes into account the cultural and religious significance that adds to the importance of the safety of the Cathedrals, in that they are considered the liturgical and spiritual hearths of the numerous Italian Dioceses, as well as monuments of a huge artistic relevance. Moreover, we test the efficiency of the risk management strategy implemented through the insurance instrument in the case of the Cathedrals referring to the factors analyzed in the previous section and summarized in Table 1.

The sample composition

The survey is based on a specific questionnaire distributed, from May to July 2018, to all the Italian Dioceses through their official email address (see "Appendix"). In Italy, there are 225 Dioceses, but the Diocese "Ordinariato Militare" was excluded from the survey, because it is the only one without Cathedral.

A Diocese is defined as "a portion of the people of God which is entrusted to a Bishop for him to shepherd with the cooperation of the presbyterium", according to the article 369 of the Code of Canon Law. In other words, it is a religious territorial portion held by a Bishop who has "all ordinary, proper, and immediate power which is required for the exercise of his pastoral function" (art. 381, Code of Canon Law), including the management of the unique Cathedral that characterizes each Diocese.

As far as the sample composition is concerned, the achieved coverage is equal to 29.02% of the Italian Dioceses, corresponding to 65 answers out of a total of 224 contacts.

On the base of the classification by their size, the Dioceses can be divided into three classes (Small, Medium and Large) depending on the number of inhabitants, according to the data published by CEI (Conferenza Episcopale Italiana—Italian Bishops' Conference) in 2014. Table 2 expresses the percentages of the collected data.

The obtained sample can be considered representative, because it consists of elements from all the categories. In particular, the sample is composed of respondents from the Territorial Prelacy of Loreto, which is characterized by approximately 11,000 inhabitants, up to the Milan Diocese, which, with its 5,450,312 inhabitants, is the largest Diocese in Italy.

On the base of the partition of the obtained answers in terms of geographical area, a good coverage of all the national territory emerges, as Table 3 shows.

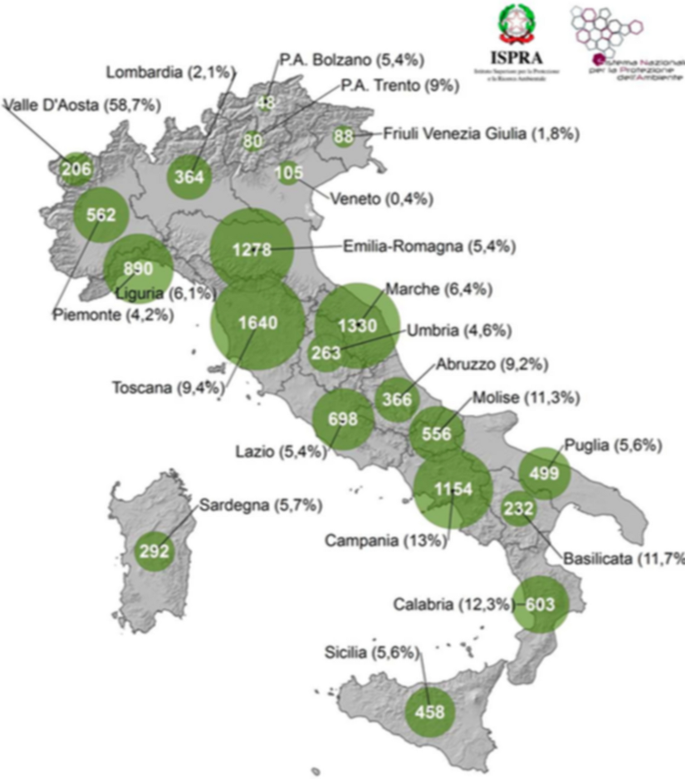

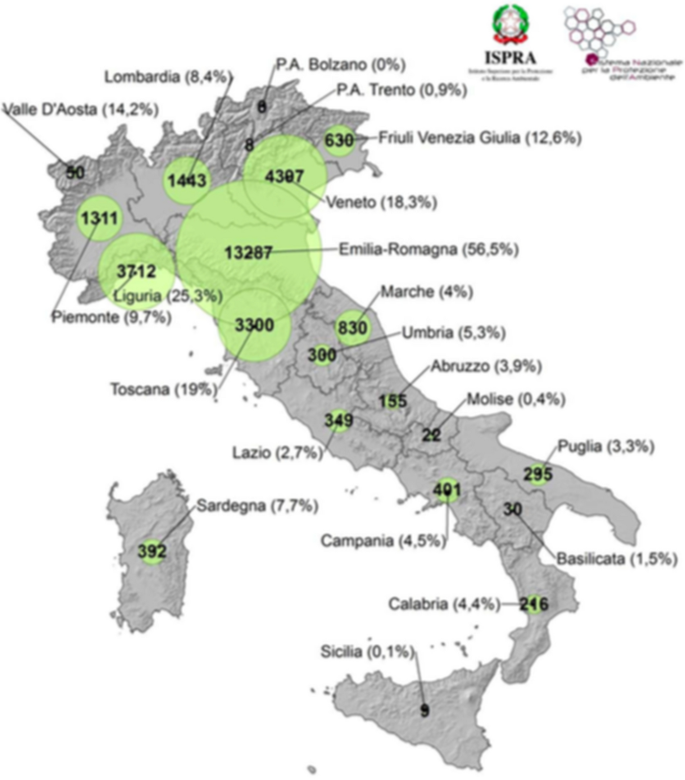

Proceeding to consider the coverage of the entire national territory, another important aspect to take into account is the one of the risk exposed areas in connection to the national Cultural Heritage. In this perspective the official reports realized by ISPRA (Istituto Superiore per la Protezione e la Ricerca Ambientale—The Italian Institute for Environmental Protection and Research) regarding the hydrogeological risks in Italy represent an important benchmark. Particularly, ISPRA (2018) provides recent data about the cultural assets at risk of landslides in Italy (that are 37,847 equal to 18.6% of the total) and about the cultural assets at risk of floods (that are on average 39,426 equal to the 19.4% of the total).

Looking at the two figures below, they show the different diffusion of cultural assets at risk of landslides (Fig. 1) and flood (Fig. 2). Going into detail, ISPRA considers cultural assets the set of historical centers, medieval villages, monuments, historical and religious buildings, churches and archeological sites.

Source: ISPRA (2018, p. 103)

Map of cultural assets at risk of landslides along the national territory. Legend: The number in the circles represents the number of cultural assets at risk of landslides in each region.

Source: ISPRA (2018, p. 145)

Map of cultural assets at risk of flood along the national territory. Legend: The number in the circles represents the number of cultural assets at risk of flood in each region.

By considering the two maps together, it emerges that the national territory is highly exposed to natural disasters of different type and each region presents specific risks linked to the natural exposure of the area. Therefore, by comparing these considerations to the obtained answers, the latter come from different regions, with different levels of risk, with a majority of answers from the Center of Italy that is the geographical area characterized by a higher number (and percentage) of cultural assets at risk. As a consequence, also in this case, the sample represents a good coverage.

Data description and variables definition

The first question addressed by the survey is about the spread of the natural catastrophe insurance policies within Italian Cathedrals.

Particularly, the question asks respondents to specify if there is an insurance contract for the Cathedral of the related Diocese to cover damages deriving from natural disasters. In the case of a negative answer, the following question asks the respondent to specify the reasons for this. The aforementioned reasons are listed in Table 4.

Based on the survey, 62% of respondents underwrote an insurance policy to cover the damages deriving from natural disasters.

In contrast, according to ANIA (2018), there is a much lower spread of natural catastrophe insurance in the Italian market. In particular, data show that 93.2% of policies do not include any natural catastrophe extension. Taking into account the number of insurance policies with an extension to natural disasters and the number of private houses in Italy, only 766,000 houses are insured, Footnote 4 compared to the total (31,2 million, according to the data provided by ISTAT—the Italian National Statistical Institute) and this corresponds to a very low level of penetration (around 2.5%).

The notable difference between insured Cathedrals and insured private houses Footnote 5 could appear to be justified by the differences in the financial resources of private citizens and Cathedrals because, while private citizens can use only their personal money, Cathedrals can use Dioceses' economic resources (also including donations) to underwrite insurance.

However, a relevant reason why the insurance spread is higher for Cathedrals is based on the difference of values embedded in the insured object. As stated in Sect. 2, Cathedrals stand out not only for their economic value but also for their cultural relevance, differently from private houses that usually have a lower cultural value. Therefore, this additional value that characterizes Cathedrals emerges as an element motivating the insurance choice because of their cultural relevance and their importance for entire populations, stimulating to safeguard and protect them in a special way, like purchasing an insurance coverage.

After the first specific question about the underwriting of an insurance contract (IC), other variables were defined, using the answers to the specific questions listed in Table 5.

As shown in Table 5, the variables are all quantitative. In detail, the first variable (RP) is directly linked to the perception Dioceses administrators have about the risk exposure of their own territory to natural disasters. The second variable (Ins_Imp) focuses on the idea they have about the role of insurance and the relative values. The third (TC) and the fourth variable (SP) are based on the role that tax concessions have on the process of underwriting and on the prospect of underwriting a specific contract linked to the characteristic of their own territory, compared to a scenario of standard contracts equal for everyone independent from the characteristics of the insured.

For these four variables, the associated question is structured following the Likert scale technique with five items that goes from 1 (that stands for lowest value) to 5 (that stands for highest value). For the TC variable the values are from 1 for "very low relevance" to 5 "elevated incentive" for the SP variable the values are from 1 for "indifference" to 5 "strong preference".

The next variable (PE) is constructed on the basis of the answers to a single question on possible catastrophic events experienced in the past, with value 0 in case of "no events" and value 1 in case of "past events". The following variable (Ins_Ben) takes into account the hypothesis of having benefitted from a compensation in force of an insurance contract. Therefore, it is equal to 0 in case of "no insurance coverage" and equal to 1 in case of "insurance coverage".

The seventh variable (WTP) takes into account the willingness to pay of each Diocese, with the relative question to specify the willingness to pay through a scale of six options so structured: from 0 to 1000€; from 1000 to 2000€; from 2000 to 3000€; from 3000 to 4000€; from 4000 to 5000€; more than 5000€ (with the request to specify the amount).

Furthermore, two variables are included to represent Religious Habits (RH) and the Dioceses Size (DS). Particularly, the values associated with the Religious Habits variable are based on the national survey conducted by ISTAT. It provides information about religious beliefs and habits of each Italian region, with values expressed in relation to the relative population, considering the percentage of citizens that take part in Catholic events.

The Dioceses were divided on the base of their size (depending on the number of inhabitants, according to the data by CEI, as described above) in three classes: Small Dioceses (with a number of inhabitants fewer than 150,000); Medium Dioceses (with a number of inhabitants between 150,000 and 500,000); Large Dioceses (with a number of inhabitants greater than 500,000).

It can be useful to describe the variables more accurately, by evaluating information in terms of the minimum and the maximum value, the first and the third quartile, the median value and the mean, given the sample of 65 elements.

Table 6 shows the mean values of the variables considered. The variable IC (insurance contracts) underlines once more the result of 62% for the spread of insurance within the Italian Cathedrals, as stated above. The mean value of RP (Risk Perception) shows how much respondents feel they are exposed to disaster risk, with a value that is a bit over the half of the total: on a scale of 1–5, the result obtained is equal to 2.738. In particular, the value distribution is presented in Table 7.

Besides, the variables associated with the importance of insurance, tax concessions and specific contracts (Ins_Imp, TC and SP) show a mean value that is very high. In particular, for Ins_Imp we obtained a value of 4.016, out of a maximum of 5, for TC 3.951 and for SP 3.672. This means that respondents give great importance to insurance as a private solution to cover the damages deriving from natural disasters. Moreover, the high percentage of the insurance spread could increase according to the mean results of the variables TC and SP, respectively, linked to the relevance of tax concessions and the possibility to underwrite specific contracts. In other words, an incentive that comes from the State in terms of tax concessions, or from the private insurance companies in terms of specific contracts, could have a relevant effect in the underwriting of insurance contracts. In more detail, these variables present the frequency presented in Table 8, 9 and 10.

In terms of the efficiency of the insurance system, adverse selection appears not to be relevant, and the Dioceses seem to be motivated not only by their level of risk, given that also the less vulnerable ones decide to insure. Moreover, from a comparison between the origin of the answers and the physical exposure of each Italian region it emerges that they know the risk they are exposed to, they move beyond this consideration and decide to safeguard Cathedrals by underwriting insurance contracts in any case.

To have a deeper insight into the data related to the WTP variable, Table 11 shows the results obtained, subdivided into the categories indicated in the multiple-choice question to the Dioceses.

Looking at Table 11, a relevant difference within the answers emerges. In particular, more or less half of the respondents can be placed into the first two categories, while the remaining ones can be placed in the other four. The class "> 5000€" involves different answers: we can find, indeed, values slightly greater than 5000€, up to values above 50,000€.

Empirical results

First of all, we investigate the presence of correlation between the data collected through the survey performing an analysis of the correlation of the explanatory variables using the Pearson correlation method and we present the results in Table 12.

Table 12 shows interesting correlations characterizing the data from the survey. First of all, there is a high correlation of the variable IC with the variable PE, meaning a strong connection between the choice to underwrite insurance and the past experience.

In particular, to better understand this high correlation, it is important to consider a specific aspect related to the PE variable: it emerges that 55.74% of respondents affirm having had past events. This demonstrates that if the Bishops experienced events connected to natural disasters, they pay attention to finding the right solutions to protect the Cathedrals they administer, and this evaluation is reinforced by the mobility rule that they have to follow to be head of the Dioceses and the consequent prevention culture they develop along their path. Another result in terms of efficiency is that the choice to be insured appears to be a consequence of informational knowledge about the risk vulnerability that comes both from knowledge of the future (increasing) trend in natural disasters and from previous experiences (Gizzi et al. 2020).

Considering the variable Risk Perception (RP), it is highly correlated to the variable Ins_Imp. This is the demonstration that the perception of risk (RP) is directly linked to the importance of the insurance (Ins_Imp), as an instrument to cover the damages deriving from natural disasters. Moreover, if a Diocese benefited from an insurance refund, it would be more inclined to recognize the importance of an insurance policy.

The variable corresponding to tax concessions (TC) is correlated to the Insurance Importance variable (Ins_Imp) and the underwriting of a specific contract (SP): on one hand, the greater the amount of tax concession, the higher the relevance of insurance; on the other hand, tax concession and specific contracts are both connected to a future perspective that can encourage the underwriting of an insurance policy.

We can interpret these results as a signal of the limited presence of moral hazard, because it emerges that the choice to insure the Cathedrals does not lead to a reduction in the prevention effort, but quite the contrary, is connected with the possibility to underwrite a specific contract and to benefit from a tax reduction.

Furthermore, in order to understand how significant those explanatory variables are on the binary variable IC, we perform a logistic regression through a logistic function of the following type:

$$p\left( {Y = 1|X} \right) = \frac{{e^{{\beta_{0} + \beta_{1} X_{1} + \cdots + \beta_{p} X_{p} }} }}{{1 + e^{{\beta_{0} + \beta_{1} X_{1} + \cdots + \beta_{p} X_{p} }} }}$$

(1)

The function (1) shows the predicting probability of having insurance, adopting a multiple logistic regression model. In particular, it allows us to estimate a binary response (\(Y = 1\) in case of insurance, \(Y = 0\) otherwise) where \(X = \left( {X_{1} , \ldots , X_{p} } \right)\) are \(p\) predictors, using the maximum likelihood method to estimate \(\beta_{0 } , \beta_{1} , \ldots , \beta_{p} .\)

The function (1) is used to identify the motivations behind the decision to underwrite an insurance contract, taking into account the data from the survey.

The parameter chosen for evaluating a fitted model is the one of the significance of the variables, as in Table 13.

Looking at Table 13, it is evident that 4 variables mainly affect the Dioceses decision: Risk Perception (RP), Insurance Importance (Ins_Imp), Past Events (PE) and Willingness to Pay (WTP). In order to make the analysis more accurate, in Table 14 the nonsignificant variables are eliminated, checking to see if the results of the model improve considering the parameter of the AIC.

Comparing Tables 13 and 14, the second fits better to the data of the survey. The AIC parameter of the latter model, equal to 51.169, is less than the one obtained for the previous model, equal to 55.751. For this reason, it is more accurate to proceed with the analysis considering the latter model.

By substituting estimates for the regression coefficients above obtained into (1), the estimated equation becomes:

$$p\left( {Y = 1|X} \right) = \frac{{{\text{e}}^{{ - 2.3610461 - 1.1350994\, RP + 0.7152156\, {\text{Ins}}\_{\text{Imp}} + 3.7693166 \,PE + 0.0007306\, WTP}} }}{{1 + {\text{e}}^{{ - 2.3610461 - 1.1350994 \,RP + 0.7152156\, {\text{Ins}}\_{\text{Imp}} + 3.7693166\,PE + 0.0007306\, WTP}} }}$$

(2)

Analyzing Table 14, Past Events (PE) emerges as the most significant variable. This result demonstrates that if a Diocese experienced a disaster in the past, it would be more inclined to be insured to those events. As a confirmation of what obtained, Risk Perception (RP) appears as a significant variable. Therefore, the more they feel exposed to risk the higher will be the probability to underwrite an insurance coverage.

Connecting this result to all the considerations in previous sections, it is possible to affirm that Dioceses administrators are greatly interested in safeguarding their heritage and identify in the insurance system a useful instrument to be adopted to protect their Cathedrals, as the significance code for the variable Ins_Imp suggests.

The significant level associated with the Willingness to Pay (WTP) is due to the fact that more money a Diocese is willing to pay, the more it is likely to invest in insurance coverage. Willingness to pay is not always equal to the availability of financial resources; therefore, this result allows to affirm that if Dioceses could have greater financial resources, it would be possible to obtain a greater spread of insurance.

In this direction, recently a first scheme of national insurance protection against catastrophe risks was signed between CEI and an Italian insurance company. This national system will provide for a homogeneous system to protect the Cultural Heritage that the Italian Cathedrals represent.

Conclusions

Focusing on the threat of natural disasters for Cultural Heritage, we analyzed the choice of Dioceses administrators in the risk management of the Cathedrals, taking into account different decisional variables detected through a questionnaire.

What emerged is that among the Italian Dioceses there is a high perception of their vulnerability and good knowledge about how to manage natural disasters risks. This demonstrates the sensitivity of the ecclesiastic world towards the protection of their historic-artistic-religious heritage. In particular, this research shows that the Dioceses administrators, and therefore Bishops, are aware of the level of risk of the Cathedrals, due to past experiences linked to the exposure of the territory or personal events they experienced in other regions, as often declared by respondents. Differently than private citizens, Dioceses administrators and Bishops show an in-depth financial culture, more specifically an insurance culture, and a good knowledge of the importance of these kinds of insurance instruments in the governance of disaster risk. Moreover, the insurance system appears to be efficient in relation to the adverse selection, moral hazard and charity hazard. In other words, this means that all traditional problems linked to the low diffusion of insurance have been overcome, in this specific case, thanks to their awareness about the importance of directly intervening to safeguard Cathedrals.

The dichotomy of values, economic and cultural, that characterizes Cathedrals amplifies the role of these monuments in our society and leads to the adoption of insurance for the coverage of material damages and the associated cultural ones. Differently from private buildings, the exposure of Cathedrals to natural disasters includes specific evaluations linked to their intrinsic values. Therefore, Cathedrals need to be preserved in a special way in order to enhance not only the historical monument but also all the intangible elements that are intrinsic to this type of cultural asset.

Indeed, Cathedrals cover a relevant role in Italian Cultural Heritage as historical, religious and artistic monuments that contribute to creating a sense of affinity with the traditions and values they bring. This leads us to highlight the importance of insurance, as a private solution that can be adopted in order to cover the damages deriving from natural disasters. Through the spread of this kind of intervention, it should be possible to efficiently safeguard Cathedrals as well as all other cultural goods, enhancing the importance Cultural Heritage has in our society.

In accordance to what has been outlined in this article in terms of elements that affect the decisional process, some future considerations can be made in the perspective of providing solutions that can establish a strategy to efficiently contrast the damages deriving from natural disasters and preserve Cultural Heritage for future generations considering the role for insurance as a relevant risk management instrument.

References

-

Abraham, K. (1995). Efficiency and fairness in insurance risk classification. Virginia Law Review, 71(3), 403–451.

-

ANIA. (2018). L'assicurazione Italiana, 2017–2018. Rome.

-

Angelini, F., & Castellani, M. (2019). Cultural and economic value: A critical review. Journal of Cultural Economics. https://doi.org/10.1007/s10824-018-9334-4.

-

Bonazza, A., Maxwell, I., Drdácky, M., Vintzileou, E., & Hanus, C. (2018). Safeguarding Cultural Heritage from natural and man-made disasters—A comparative analysis of risk management in the EU. Working paper, Publication Office of the European Union, Brussels. https://doi.org/10.2766/224310.

-

Coviello, A. (2013). Calamità naturali e coperture assicurative. Il risk management nel governo dei rischi catastrofali. Dario FlaccovioEd.

-

Dastgerdi, A. S., Sargolini, M., & Pierantoni, I. (2019). Climate change challenges to existing Cultural Heritage policy. Sustainability, 11(19), 5227.

-

Daungthima, W., & Hokao, K. (2013). Analysing the possible physical impact of flood disasters on Cultural Heritage in Ayutthaya, Thailand. International Journal of Sustainable Future for Human Security, 1, 35–39.

-

De Masi, F., & Porrini, D. (2018). Vulnerability to natural disasters and insurance: Insights from the Italian case. International Journal of Financial Studies, 6, 56. https://doi.org/10.3390/ijfs6020056.

-

De Masi, F., & Porrini, D. (2019). The role of insurance in the governance of disaster risk: The case of Italian Cathedrals. Insurance Markets and Companies, 10(1), 9–25. https://doi.org/10.21511/ins.10(1).2019.02.

-

Dekker, E. (2014). Two approaches to study the value of art and culture, and the emergence of a third. Journal of Cultural Economics, 39(4), 309–326. https://doi.org/10.1007/s10824-014-9237-y.

-

European Parliament. (2007). Protecting the Cultural Heritage from natural disasters. IP/B/CULT/IC/2006_163. Brussel.

-

Fatorić, S., & Seekamp, E. (2017). Are Cultural Heritage and resources threatened by climate change? A systematic literature review. Climatic Change, 142, 227–254. https://doi.org/10.1007/s10584-017-1929-9.

-

Gizzi, F. T., Potenza, M. R., & Zotta, C. (2016). The insurance market of natural hazards for residential properties in Italy. Scientific Research Publishing, 5(1), 35–61. https://doi.org/10.4236/ojer.2016.51004.

-

Gizzi, F. T., Kam, J. & Porrini, D. (2020). Time windows of opportunities to fight earthquake under-insurance: evidence from Google Trends. Humanities & Social Sciences Communication, 7, 61. https://doi.org/10.1057/s41599-020-0532-2.

-

Hernando, E., & Campo, S. (2017). An artist's perceived value: Development of a measurement scale. International Journal of Arts Management, 19(3), 33–47.

-

Hutter, M., & Shusterman, R. (2006). Value and the valuation of art in economic and aesthetic theory. In V. A. Ginsburgh & D. Throsby (Eds.), Handbook of the economics of art and culture (Vol. 1, pp. 169–208). Amsterdam: Elsevier.

-

ISPRA. (2018). Dissesto idrogeologico in Italia: Pericolosità e indicatori di rischio—Edizione 2018. Edited by Trigila A., Iadanza C., Bussettini M., Lastoria B., Rapporti 287/2018.

-

Klamer, A. (2008). The lives of cultural goods. In J. Amariglio, J. W. Childers, & S. E. Cullenberg (Eds.), Sublime economy: On the intersection of art and economics (pp. 250–272). London: Routledge.

-

Kunreuther, H. (2015). The role of insurance in reducing losses from extreme events: The need for public–private partnerships. Geneva Risk and Insurance Review. https://doi.org/10.2139/ssrn.2596893.

-

Laidlaw, P., Spennemann, D. H., & Allan, C. (2008). Protecting cultural assets from bushfires: A question of comprehensive planning. Disasters, 32, 66–81. https://doi.org/10.1111/j.1467-7717.2007.01027.x.

-

Maio, R., Ferreira, T. M., & Vicente, R. (2018). A Critical discussion on the earthquake risk mitigation of urban cultural heritage assets. International Journal of Disaster Risk Reduction., 27, 239–247. https://doi.org/10.1016/j.ijdrr.2017.10.010.

-

Marini, P. (2010). La Chiesa Cattedrale centro della vita liturgica della Diocesi. Pavia, September 2010, edited by Pontificio Comitato per i Congressi Eucaristici.

-

Porrini, D. (2015). Risk classification efficiency and the insurance market regulation. Risks, 3(4), 445–454. https://doi.org/10.3390/risks3040445.

-

Porrini, D., & Schwarze, R. (2014). Insurance models and European climate change policies: An assessment. European Journal of Law and Economics, 38(1), 7–28. https://doi.org/10.1007/s10657-012-9376-6.

-

Prometeia. (2019). Natural disasters in Italy: Evolution and economic impact, P. Lazzaretto (Ed.), Note di Lavoro, 01-2019.

-

Raschky, P. A., & Weck-Hannemann, H. (2007). Charity hazard—A real hazard to natural disaster insurance? Environmental Hazards, 7(4), 321–329. https://doi.org/10.1016/j.envhaz.2007.09.002.

-

Sesana, E., Gagnon, A. S., Bertolin, C., & Hughes, J. (2018). Adapting Cultural Heritage to climate change risks: Perspectives of Cultural Heritage experts in Europe. Geosciences, 8(8), 305.

-

Smith, T. (2008). Creating value between cultures: Contemporary Australian aboriginal Art. In M. Hutter & D. Throsby (Eds.), Beyond price (pp. 23–40). New York, NY: Cambridge University Press.

-

Spennemann, D. H. R. (1999). Cultural Heritage conservation during emergency management: Luxury or necessity? International Journal of Public Administration, 22(5), 745–804. https://doi.org/10.1080/01900699908525403.

-

Spennemann, D. H. R., & Graham, K. (2007). The importance of heritage preservation in natural disaster situations. International Journal of Risk Assessment and Management, 7(6–7), 993–1001.

-

Stapp, D. C., & Longenecker, J. G. (2009). Avoiding archeological disasters: A risk management approach. New York: Left Coast Press.

-

Sugio, K. (2015). Large-scale disasters on world heritage and Cultural Heritage in Japan: Significant impacts and sustainable management cases. Landscape Research, 40(6), 748–758.

-

Taboroff, J. (2000). Cultural Heritage and natural disasters: Incentives for risk management and mitigation. Managing Disaster Risk in Emerging Economies, 2, 71–79.

-

Throsby, D. (2001). Economics and culture. Cambridge: Cambridge University Press.

-

Throsby, D. (2003). Determining the value of cultural goods: How much (or how little) does contingent valuation tell us? Journal of Cultural Economics, 27(3–4), 275–285. https://doi.org/10.1023/a:1026353905772.

-

Throsby, D., & Zednik, A. (2014). The economic and cultural value of paintings: Some empirical evidence. Handbook of the Economics of Art and Culture, 2, 81–99. https://doi.org/10.1016/B978-0-444-53776-8.00004-0.

-

UNESCO. (1972). Convention concerning the protection of the world cultural and Natural Heritage. The General Conference of the United Nations Educational, Scientific and Cultural Organization meeting, seventeenth session, Paris 17 October–21 November 1972.

-

UNESCO. (1992). Convention concerning the protection of the world cultural and Natural Heritage. World heritage committee, sixteenth session, Santa Fe, United States of America, 7–14 December 1992.

-

UNESCO. (2003). Convention for the safeguarding of the intangible cultural heritage. The General Conference of the United Nations Educational, Scientific and Cultural Organization meeting, thirty-second session, Paris, 29 September–17 October 2003.

-

Vecco, M. (2010). A definition of Cultural Heritage: From the tangible to the intangible. Journal of Cultural Heritage, 11(3), 321–324. https://doi.org/10.1016/j.culher.2010.01.006.

-

Vecco, M., & Imperiale, F. (2017). Cultural Heritage: Values and measures. What insurance value? Journal of Multidisciplinary Research, 9(1), 7–22.

Source: https://link.springer.com/article/10.1007/s10824-020-09397-x

0 Response to "Continuous Bulding on a Cathedral to Prevent Disaster"

Post a Comment